In the second part of the TUM São Paulo Insights series, Liaison Officer Sören Metz presents Latin America as an innovation location. With almost 650 million people in the region and the diverse cultural influences from 33 countries as well as the high population density in the metropolitan areas, there is great potential for innovative entrepreneurial activities.

According to the Global Entrepreneurship Monitor (GEM) 2019/2020, the six most entrepreneurially motivated persons are all in the Latin America and Caribbean region. Entrepreneurial activity has become an important opportunity for the development of their careers, especially for the more than 150 million young people between the ages of 15 and 29.

Complexity vs entrepreneurial spirit

Even though the business environment in many of the economies affected can be difficult, entrepreneurial activity in Latin America and the Caribbean is high based on GEM surveys. It fits the mould that, according to the Global Business Complexity Index (GBCI), Brazil, Bolivia and Peru are among the most complex economic markets in the world.

The GBCI assesses how easy or complex it is for entrepreneurs to do business in a country and ranks the economies according to this complexity. According to the current ranking, Latin American countries in particular are amongst the top 20: Brazil takes the third place, followed by Bolivia (5th), Peru (10th), El Salvador (11th), Colombia (13th), and Argentina (18th).

This may initially seem paradoxical and hinder entrepreneurial activities. However, other factors such as social and cultural norms, the lack of alternative income opportunities and the extent of competition as well as the growth of the economies in the past decades also come into play here.

What the rest of the world can learn from Latin America

Given the entrepreneurial requirements described, startups and founders in Latin America must be particularly resilient to build up their businesses. Many of these startups are proof that it can be beneficial to build a company under these conditions.

Instead of raising external funds to launch a product on the market, startups in Latin America have developed their own success strategies – in most cases out of sheer necessity. Due to the less lavish financing rounds in the region, startups have to get real and focus on paying customers early on.

Founding startups to the benefit of the region

The key to expansion in new markets is adaptability: Latin American founders – especially those outside the large markets of Mexico and Brazil – strategically include several regional markets from the start in order to place their company and take advantage of economies of scale.

Furthermore, startups in Latin America in most cases tackle the problems that move the region. For example, Mariana Costa Checa, founder of the Peruvian company Laboratoria, trains women to become web designers and computer scientists and then places them in companies in need of these talents. The startup is active in five Latin American countries and has already trained over 7,000 participants.

Investment boom in the region

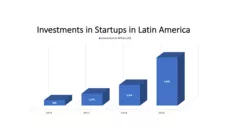

In Latin America, investment in startups has increased in recent years and more capital is now available than ever before. A look at the five-year investment trends in the region shows that the number of investors, according to the Latin American Venture Capital Association (LAVCA), has more than doubled annually since 2016. While the 2016 investment was $ 500 million, in 2019 it reached almost ten times that value with $ 4.6 billion.

Since this increase in financing rounds has only taken place in recent years and the funding volume has still not reached the level of other international hotspots in the area of innovation, another business idea emerged: a startup exchange, in which previously ranked startups are brought together directly with representatives from industry and the private sector. The 100 Open Startup System was developed in Brazil and is also active in Colombia, Chile, Peru, and Mexico.

SoftBank's Vision Fund has also had a Latin American spin-off since 2019. SoftBank increased its $ 2 billion regional fund by another $ 1 billion in February 2020 and is investing across the whole region.

German startups and Latin America

How can German startups learn from this region and invest here? The Startups Connected program, which the German-Brazilian Chamber of Commerce and Industry São Paulo announces annually, offers an opportunity for cooperation with Brazil.

The 'Sustainble Brazil' category is specifically aims at startups from German universities or research institutions that are relevant to Brazil. The application deadline for the current call is August 09, 2020. The participation of TUM startups has been under a good star since SoilSpy won in this category in 2018. When applying, German startups should focus on solutions to the UN Millennium Goals.

For the process of entering the market in Argentina, Chile, Colombia, and Peru, the Bavarian Representation for South America based in Chile can support German startups and establish contact with local business partners.

If you would like to find out more about the various cooperation opportunities in the Latin America region, TUM São Paulo Liaison Officer Sören Metz is always happy to help.

Sources

- GEM 2019/2020 Report: https://www.gemconsortium.org/report/gem-2019-2020-global-report

- Laboratoria: https://www.laboratoria.la/br

- Latin American Venture Capital Association (LAVCA): https://lavca.org/

- 100 Open Startups: https://www.openstartups.net/site/infografico.html

- Softbank Latin American Fund: https://techcrunch.com/2020/02/27/latin-america-roundup-softbank-adds-1b-stori-raises-10m-and-grow-mobility-puts-on-the-brakes/

- Startups connected: Sustainble Brazil: https://startupsconnected.com.br/en/sustainable-brazil/

- SoilSpy – Winner 2018: https://www.dwih-saopaulo.org/de/2019/06/24/wettbewerb-fuer-deutsche-startups-mit-blick-auf-den-brasilianischen-markt/

- State of Bavaria Office for South America: https://www.bavariaworldwide.de/chile/ueber-uns/